Bitcoin kurve

Die Bitcoin-Kurve ist ein wichtiges Konzept für alle, die in Kryptowährungen investieren. Es ist entscheidend, die verschiedenen Faktoren zu verstehen, die die Bitcoin-Kurve beeinflussen können, um fundierte Investitionsentscheidungen zu treffen. Hier sind 4 Artikel, die Ihnen helfen können, die Bitcoin-Kurve besser zu verstehen:

Die Bedeutung von Marktnachrichten für die Bitcoin-Kurve

In Germany, the significance of market news for the Bitcoin curve cannot be underestimated. Market news plays a crucial role in shaping the trajectory of Bitcoin prices, as investors closely monitor developments in the financial markets to make informed decisions. The correlation between market news and Bitcoin prices has been well-documented, with studies showing that positive news can lead to an increase in Bitcoin prices, while negative news can have the opposite effect.

One key example of the impact of market news on the Bitcoin curve is the recent announcement by Tesla that it had invested

Die Bitcoin-Kurve ist ein wichtiges Konzept für alle, die in Kryptowährungen investieren. Es ist entscheidend, die verschiedenen Faktoren zu verstehen, die die Bitcoin-Kurve beeinflussen können, um fundierte Investitionsentscheidungen zu treffen. Hier sind 4 Artikel, die Ihnen helfen können, die Bitcoin-Kurve besser zu verstehen:

.5 billion in Bitcoin. This news sent shockwaves through the market, causing a surge in Bitcoin prices as investors rushed to capitalize on the endorsement from one of the world's most prominent companies. Similarly, news of regulatory crackdowns or security breaches can lead to a sharp decline in Bitcoin prices, as investors panic and sell off their holdings.Understanding the importance of market news for the Bitcoin curve is crucial for investors looking to navigate the volatile world of cryptocurrency. By staying informed and keeping a close eye on market developments, investors can position themselves to take advantage of opportunities and avoid potential pitfalls. In conclusion, the role of market news in shaping the Bitcoin curve cannot be overstated, making it essential for investors in Germany to stay informed and adapt to changing

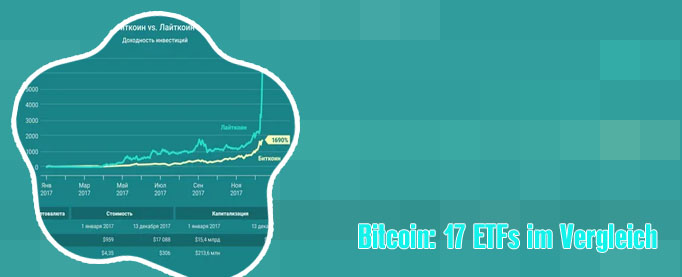

Technische Analyse: Wie sie Ihnen helfen kann, die Bitcoin-Kurve vorherzusagen

Today we are discussing the importance of technical analysis in predicting the Bitcoin curve with a focus on the German market.

Technical analysis is a crucial tool for traders and investors in the cryptocurrency space, especially in a volatile market like Bitcoin. By studying past market data, price movements, and trading volume, analysts can identify patterns and trends that may help predict future price movements. This is particularly important in the German market, where Bitcoin is gaining popularity among investors.

One key benefit of technical analysis is its ability to help traders make informed decisions based on data rather than emotions. In a market as unpredictable as Bitcoin, having a solid strategy backed by technical analysis can help mitigate risks and increase the chances of success.

Additionally, technical analysis can also help traders identify potential entry and exit points, as well as set stop-loss orders to limit losses. This is crucial for traders looking to maximize profits and minimize risks in the fast-paced world of cryptocurrency trading.

In conclusion, understanding and utilizing technical analysis can be a game-changer for investors looking to navigate the ups and downs of the Bitcoin market in Germany. By studying market data and identifying patterns, traders can make more informed decisions and increase their chances of success in this exciting and rapidly evolving market.

Warum Regulierung einen Einfluss auf die Bitcoin-Kurve haben kann

Expert: <a href"/">Anlass "Regulation plays a crucial role in shaping the trajectory of Bitcoin prices in Germany.

Langfristige Trends: Wie sie die Bitcoin-Kurve formen und was das für Investoren bedeutet

In Germany, the topic of long-term trends shaping the Bitcoin curve and its implications for investors is a subject of great interest and discussion among financial experts and enthusiasts. As the cryptocurrency market continues to evolve, it is essential for investors to understand the various factors influencing the price movements of Bitcoin over time.

One key factor that shapes the Bitcoin curve is market demand. The increasing adoption of Bitcoin as a digital asset and a store of value has led to a surge in demand, driving up prices over the long term. Additionally, macroeconomic trends such as inflation, geopolitical events, and regulatory developments can also impact the trajectory of Bitcoin prices.

Famous figures like Elon Musk and Jack Dorsey have made headlines with their support for Bitcoin, further fueling its popularity and mainstream acceptance. Events such as the halving of Bitcoin rewards, which occurs approximately every four years, have historically led to significant price increases as the supply of new coins decreases.

Places like Berlin and Frankfurt have emerged as hubs for cryptocurrency innovation, with a growing number of startups and businesses accepting Bitcoin payments. Investors in Germany are increasingly looking to diversify their portfolios with digital assets like Bitcoin, recognizing its potential for long-term growth and stability.